All courses are made available completely online within an asynchronous format, delivering you the final word overall flexibility to get paid your degree in a way that works for you personally. Courses are taught by distinguished full-time school and adjunct professors with deep awareness and tax legislation skills.

Also, Distance Education and learning gives a broader technique of conversation by which candidates from any part of the world can start their course. Given down below is actually a list of several of the colleges for your DTL course which offer distance education and learning.

As mentioned, the course fee for Diploma in tax legislation is different in several colleges and establishments, and states. Having said that, as this is the diploma course the total course rate could be all around INR 15000 and 100000.

You will be totally free to repeat, adapt, modify, transmit and distribute this materials as you want (but not in almost any way that implies the ATO or even the Commonwealth endorses you or any of your products and services or products and solutions).

We've been committed to delivering you with exact, dependable and clear information to help you understand your rights and entitlements and meet up with your obligations.

To stay away from this, Australia has entered into numerous double tax agreements with other nations which is able to prevail in excess of domestic regulation to make sure that taxation is simply imposed after on any given degree of income.

Though our investigate guides are selective, inclusion of the site or useful resource isn't going to constitute endorsement from the Law Library of Congress. Not one of the information in any of our research guides is legal tips.

As this can be a postgraduate course, the course period is just 2-years. Even though other courses are split into semesters. LLM in tax law will not be split into semesters.

Restraints to the taxing electricity are generally imposed by custom, tailor made, and political criteria; in lots of nations around the world there are constitutional restrictions. Selected constraints on the taxing power on the legislature are self-apparent. As being a realistic matter, as well as a make any difference of (constitutional) law, there have to be a minimum amount connection in between the topic of taxation and also the taxing electrical power. The extent of income-tax jurisdiction, for example, is basically determined by two major standards: the residence (or nationality) on the taxpayer and his supply of income.

DTL is undoubtedly an important and helpful course that gives detailed task openings in federal government companies, accounting firms, and law firms.

Recent years have witnessed explosive growth in non-public fairness resources and hedge cash. It truly is approximated that above $1 trillion is at present invested in hedge money globally, and assets held by non-public fairness cash may additionally exceed $one trillion. Several law firms now have specialised practice teams focused on these expenditure autos, along with the M&A tax practices of legislation firms and massive 4 accounting firms are sometimes driven by non-public fairness transactions.

Students unable to decide to the complete concentration in estate planning, but considering learning more about it, must contemplate the subsequent elective courses:

Not just about every school conduct entrance exams. A few of the colleges in India provide admission on a advantage foundation Although some carry out their own personal entrance exams. One common entrance exam with the candidates to acquire admission on the DTL course is IPU CET.

Section fifty one(ii) on the Australian Constitution grants the Commonwealth the power to impose taxes, also to impose laws regarding the collection and administration of taxes. The Constitution website also distributes taxing rights between the Commonwealth plus the States.

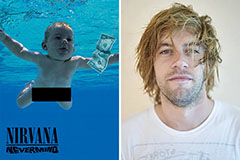

Spencer Elden Then & Now!

Spencer Elden Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!